Asset Settings

The Asset Settings section allows administrators to define key financial parameters for new asset types, ensuring accurate valuation and reporting.

Table of contents

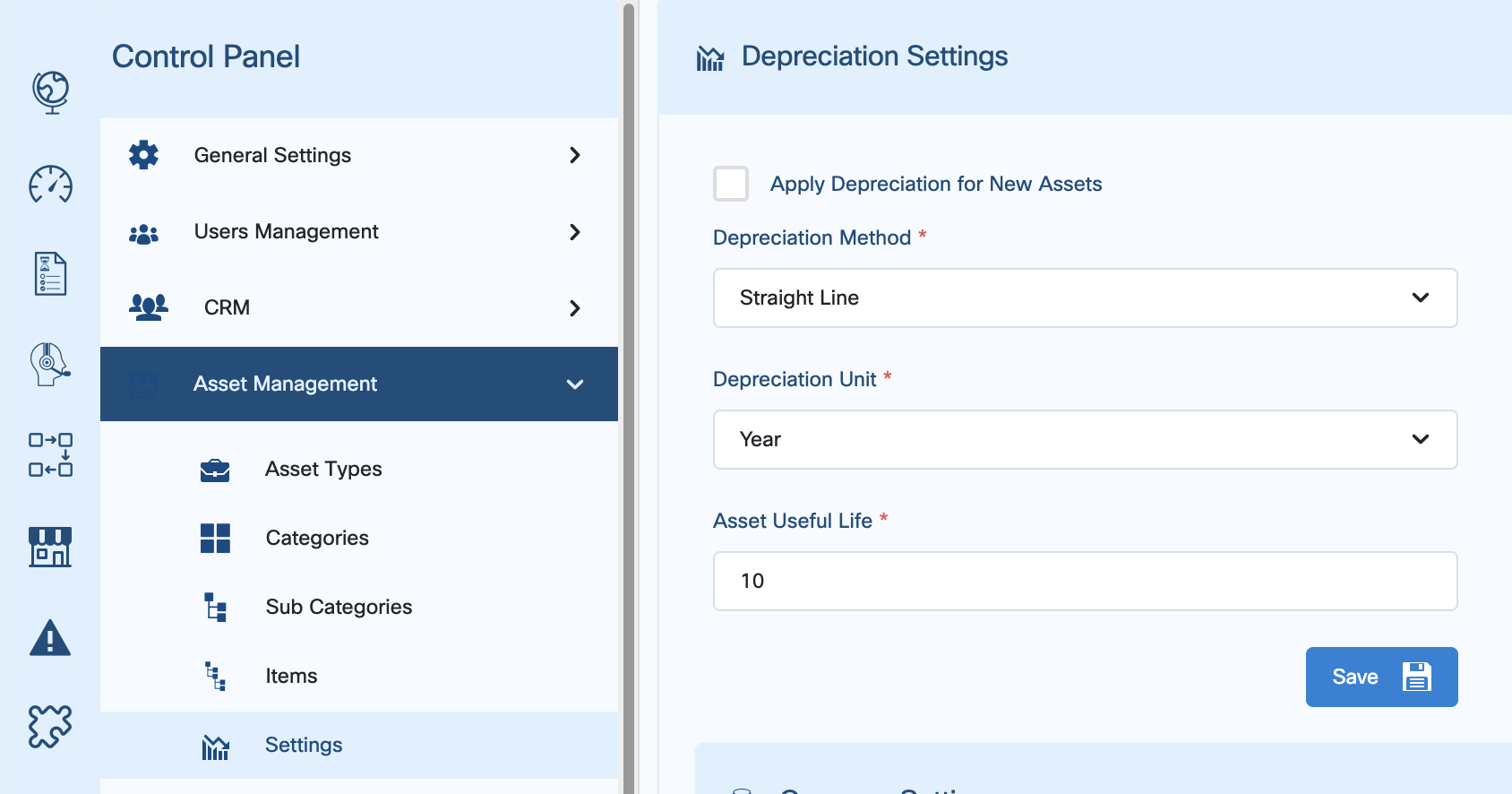

Depreciation Settings

Select from multiple depreciation methods to match your organization’s accounting practices:

Straight Line

Spreads the asset’s cost evenly over its useful life.

Double Declining Balance

Accelerates depreciation in the earlier years of the asset’s life.

Units of Production

Depreciation is based on usage or output, ideal for machinery and equipment.

Sum of Years’ Digits:

An accelerated method that depreciates assets more quickly in the early years.

These options help ensure compliance with accounting standards and support better financial planning.

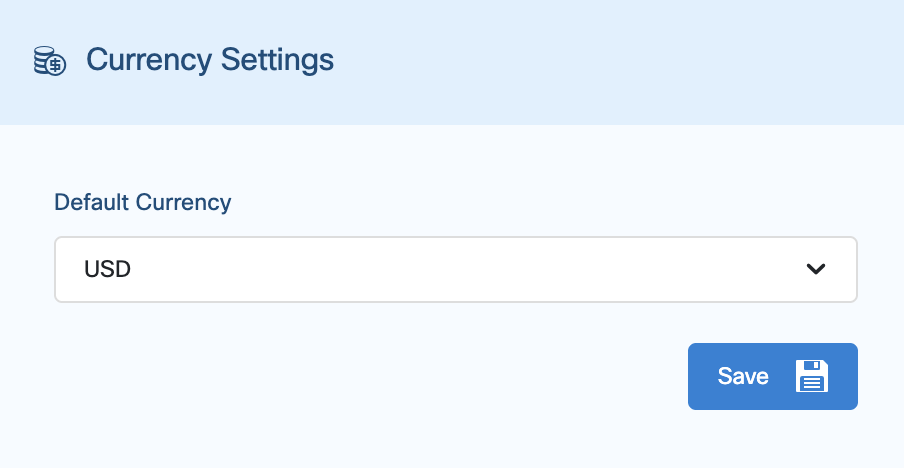

Currency Settings

Currency settings allow you to assign a specific currency to each asset type. This is particularly useful when assets are purchased in different currencies—for example, printers bought in PKR and computers purchased in USD. Defining the correct currency at the asset level ensures accurate valuation, reporting, and depreciation calculations in multi-currency environments.